Table of Contents

Investing Due Diligence

Questions

- What do you do, how do you make money?

- Is your investing strategy different for taxable account and non-taxable account? How about IRA/401k vs Roth IRA?

- Access to investments that are not available to general public?

- Communication frequency and format

- What can/should an investor control (cash reserve percentage?)

- Turn over ratio and tax consequences

- There is 1031 exchange rule to defer capital gains on real estate transactions. Is there a similar thing for investing?

- How do you individualize investment for each client?

- How is that different from a mutual fund?

- Covered calls?

- Fee structure? What services are provided?

- macro/micro environment, activity briefing (monthly)

- tax optimization

- estate planning

- retirement planning

- Logistics (Fidelity/Vanguard)

- Cost base reporting

- Win-Win-Lose

- Buy-Borrow-Die

Links

Macro Econ Indicators

Since 1870, the S&P 500 Shiller P/E has surpassed and held above 30 on only five occasions during a bull-market rally. Every single occasion was eventually followed by a pullback of at least 20%.

My Due Diligence List

- P/E, P/S, Revenue history, Market cap, Dividend yield, Payout ratio

- Historical price, P/E

- Insider trading (https://finviz.com/insidertrading.ashx)

- Institutional buy/sell

- Underlying driving force

- Reasoning - technology, exchange rate, inflation

- Technical indicators

- [Macro] Buffett indicator - global market cap / global GDP

- Nearly every major correction, crash, and bear market has been preceded by weakness in lumber

- FMS (fund manager survey) cash balance - when fell below 4%, it has indicated a correction

Warren Buffett money advice

And this isn't just his advice to others, but in fact to his family as well. In his latest annual letter to Berkshire Hathaway shareholders, Buffett provided an honest admission of where the fortune he was leaving to his wife would go:

My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard's.) I believe the trust's long-term results from this policy will be superior to those attained by most investors – whether pension funds, institutions, or individuals – who employ high-fee managers.

Warren Buffett and Bank

The bank worth buying

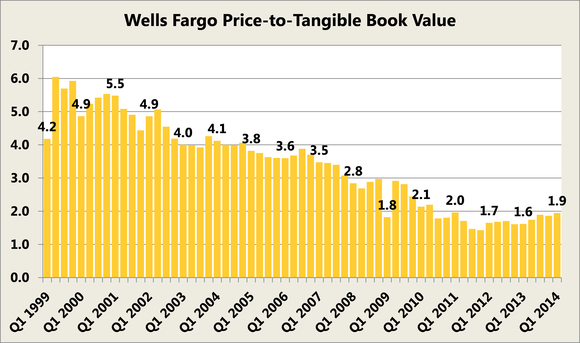

One key metric used by investors to gauge a bank's relative value is the price-to-tangible book value. Wells Fargo watched its fall as the decade progressed:

On a relative basis, Wells Fargo was put on sale nearly 10 years ago, and its price has only improved as the years have progressed. But we must see this relative discount – some banks are significantly less expensive than Wells Fargo – as only part of the equation.

Consider Buffett's quote in 2005, when the first major purchase was made:

We substantially increased our holdings in Wells Fargo, a company that Dick Kovacevich runs brilliantly.

Even though the bank's multiple was trading well below where it had for the previous five years – as shown in the chart to the right – Buffett never mentioned the relative value. Instead, he highlighted the business and the underlying leadership.

But why has Buffett continued to buy Wells Fargo?

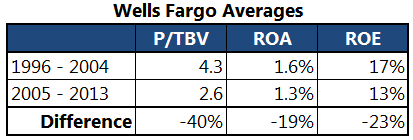

Sure, Wells Fargo's trading multiple has fallen in the nine years since Buffett began aggressively adding to his position. And although its profitability – as measured by its return on assets, or ROA, and return on equity, or ROE – has fallen as a result of the financial crisis, the gap isn't nearly as dramatic as the drop seen in its relative valuation.

The drop in its value doesn't line up with the dip in its business operations. And while the bank's multiple is still often far above its peers, remember Buffett once said:

We try to buy into businesses with favorable long-term economics. Our goal is to find an outstanding business at a sensible price, not a mediocre business at a bargain price.

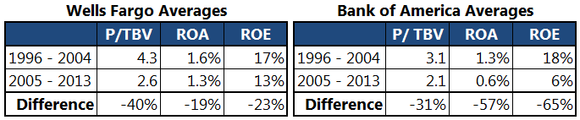

With that in mind, consider Bank of America (NYSE: BAC ) , which Buffett stake a position in after the market overreacted and its stock cratered in the fall of 2011.

Why did he aggressively continue to buy Wells Fargo, but only make the one-time investment in Bank of America? The numbers don't lie:

Bank of America saw its price-to-tangible book value plummet to just 0.5 in August 2011 when Buffett made his investment. So that chart doesn't tell the whole story.

But it does reveal why Buffett has continuously added to his stake in Wells Fargo, versus a one-time investment in Bank of America.

Put simply, there is perhaps no clearer picture of “a wonderful business at a fair price” than Wells Fargo over the last nine years.

The story of socks So what does any of that have to do with socks? Let's revisit Buffett's quote:

Long ago, Ben Graham taught me that “Price is what you pay; value is what you get.” Whether we're talking about socks or stocks, I like buying quality merchandise when it is marked down.

The final thing to remember

In 2012, Buffett said:

More than 50 years ago, Charlie [Munger] told me that it was far better to buy a wonderful business at a fair price than to buy a fair business at a wonderful price. Despite the compelling logic of his position, I have sometimes reverted to my old habit of bargain-hunting, with results ranging from tolerable to terrible.

SpeedDesk Return to Article Warren Buffett's Top 25 Stocks for 2014

J.R. deBart 08/18/14 - 10:29 AM EDT NEW YORK (TheStreet) – Warren Buffett is considered the most respected and successful investor. Often called “The Oracle of Omaha” for his impressive investing prowess, he is among the world's wealthiest people.

Buffett studied under the legendary Benjamin Graham at Columbia University who had a major impact on Buffett's life and investment strategies.

Buffett is chairman of Omaha, Nebraska-based Berkshire Hathaway Inc (BRK.A) which he built from a textile company into a major corporation with a market cap over $324 billion. Under Buffett's leadership, Berkshire shares averaged a 19.7% compounded annual gain in per share book value from 1965-2013.

He follows a value investing strategy that is an adaptation of Graham's approach: Discipline, patience and value consistently outperforms the market. His moves are followed by investors worldwide. Buffett seeks to acquire great companies trading at a discount to their intrinsic value, and to hold onto them for a long time. He will only invest in businesses that he understands, and always insists on a margin of safety.

Regarding the types of businesses Berkshire likes to purchase, Buffett has said,“We want businesses to be one that we can understand, with favorable long-term prospects, operated by honest and competent people, and available at a very attractive price.”

What follows are Buffett's top 25 holdings as of June 30, 2014…

25. Precision Castparts Corp. (PCP)

Shares Held by Warren Buffett's Berkshire Hathaway: 1,877,000 shares Value of Holdings: $474 million Portfolio Weighting as of 06/30/2014: 0.44%

Precision Castparts Corp. manufactures and sells metal components and products worldwide.

It operates in three segments: Investment Cast Products, Forged Products, and Airframe Products.

Free Report: Jim Cramer's Best Stocks for 2014

TheStreet Ratings team rates PRECISION CASTPARTS CORP as a Buy with a ratings score of A-. TheStreet Ratings Team has this to say about their recommendation:

“We rate PRECISION CASTPARTS CORP (PCP) a BUY. This is based on the convergence of positive investment measures, which should help this stock outperform the majority of stocks that we rate. The company's strengths can be seen in multiple areas, such as its revenue growth, impressive record of earnings per share growth, expanding profit margins, increase in net income and notable return on equity. Although no company is perfect, currently we do not see any significant weaknesses which are likely to detract from the generally positive outlook.”

You can view the full analysis from the report here: PCP Ratings Report 24. Costco Wholesale Corp. (COST)

Shares Held by Warren Buffett's Berkshire Hathaway: 4,333,000 shares Value of Holdings: $499 million Portfolio Weighting as of 06/30/2014: 0.46%

Costco Wholesale Corporation, together with its subsidiaries, operates membership warehouses.

The company offers branded and private-label products in a range of merchandise categories.

Free Report: Jim Cramer's Best Stocks for 2014

TheStreet Ratings team rates COSTCO WHOLESALE CORP as a Buy with a ratings score of A. TheStreet Ratings Team has this to say about their recommendation:

“We rate COSTCO WHOLESALE CORP (COST) a BUY. This is based on the convergence of positive investment measures, which should help this stock outperform the majority of stocks that we rate. The company's strengths can be seen in multiple areas, such as its revenue growth, increase in net income, largely solid financial position with reasonable debt levels by most measures, good cash flow from operations and growth in earnings per share. We feel these strengths outweigh the fact that the company has had lackluster performance in the stock itself.”

You can view the full analysis from the report here: COST Ratings Report

23. Phillips 66 (PSX)

Shares Held by Warren Buffett's Berkshire Hathaway: 6,496,000 shares Value of Holdings: $522 million Portfolio Weighting as of 06/30/2014: 0.49%

Phillips 66 operates as an energy manufacturing and logistics company.

It operates in four segments: Midstream, Chemicals, Refining, Marketing and Specialties.

Free Report: Jim Cramer's Best Stocks for 2014

TheStreet Ratings team rates PHILLIPS 66 as a Buy with a ratings score of B-. TheStreet Ratings Team has this to say about their recommendation:

“We rate PHILLIPS 66 (PSX) a BUY. This is driven by a few notable strengths, which we believe should have a greater impact than any weaknesses, and should give investors a better performance opportunity than most stocks we cover. The company's strengths can be seen in multiple areas, such as its revenue growth, solid stock price performance, attractive valuation levels and largely solid financial position with reasonable debt levels by most measures. We feel these strengths outweigh the fact that the company has had sub par growth in net income.”

You can view the full analysis from the report here: PSX Ratings Report22. National Oilwell Varco, Inc. (NOV)

Shares Held by Warren Buffett's Berkshire Hathaway: 7,302,000 shares Value of Holdings: $601 million Portfolio Weighting as of 06/30/2014: 0.56%

National Oilwell Varco, Inc. provides equipment and components for oil and gas drilling and production; oilfield services; and supply chain integration services to the upstream oil and gas industry worldwide.

Free Report: Jim Cramer's Best Stocks for 2014

TheStreet Ratings team rates NATIONAL OILWELL VARCO INC as a Buy with a ratings score of A. TheStreet Ratings Team has this to say about their recommendation:

“We rate NATIONAL OILWELL VARCO INC (NOV) a BUY. This is based on the convergence of positive investment measures, which should help this stock outperform the majority of stocks that we rate. The company's strengths can be seen in multiple areas, such as its increase in net income, revenue growth, largely solid financial position with reasonable debt levels by most measures, increase in stock price during the past year and attractive valuation levels. We feel these strengths outweigh the fact that the company shows low profit margins.”

You can view the full analysis from the report here: NOV Ratings Report21. VeriSign, Inc. (VRSN)

Shares Held by Warren Buffett's Berkshire Hathaway: 12,985,000 shares Value of Holdings: $634 million Portfolio Weighting as of 06/30/2014: 0.59%

VeriSign, Inc. provides Internet infrastructure services to various networks worldwide.

The company offers domain name registry services that operate the authoritative directory of .com, .net, .cc, .tv, and .name domains, as well as the back-end systems for various .gov, .jobs, and .edu domains.

Free Report: Jim Cramer's Best Stocks for 2014

TheStreet Ratings team rates VERISIGN INC as a Buy with a ratings score of B-. TheStreet Ratings Team has this to say about their recommendation:

“We rate VERISIGN INC (VRSN) a BUY. This is driven by a number of strengths, which we believe should have a greater impact than any weaknesses, and should give investors a better performance opportunity than most stocks we cover. The company's strengths can be seen in multiple areas, such as its increase in stock price during the past year, compelling growth in net income, revenue growth, expanding profit margins and impressive record of earnings per share growth. We feel these strengths outweigh the fact that the company shows weak operating cash flow.”

You can view the full analysis from the report here: VRSN Ratings Report20. Viacom, Inc. (VIAB)

Shares Held by Warren Buffett's Berkshire Hathaway: 7,607,000 shares Value of Holdings: $660 million Portfolio Weighting as of 06/30/2014: 0.61%

Viacom Inc. operates as an entertainment content company in the United States and internationally.

The company creates television programs, motion pictures, short-form video, apps, consumer products, social media, and other entertainment content.

Free Report: Jim Cramer's Best Stocks for 2014

19. M&T Bank Corp. (MTB)

Shares Held by Warren Buffett's Berkshire Hathaway: 5,382,000 shares Value of Holdings: $668 million Portfolio Weighting as of 06/30/2014: 0.62%

M&T Bank Corporation operates as the bank holding company for M&T Bank that provides commercial and retail banking services.

The company's Business Banking segment offers deposit, lending, cash management, and other financial services to small businesses and professionals.

Free Report: Jim Cramer's Best Stocks for 2014

TheStreet Ratings team rates M & T BANK CORP as a Buy with a ratings score of A. TheStreet Ratings Team has this to say about their recommendation:

“We rate M & T BANK CORP (MTB) a BUY. This is based on the convergence of positive investment measures, which should help this stock outperform the majority of stocks that we rate. The company's strengths can be seen in multiple areas, such as its expanding profit margins and reasonable valuation levels. We feel these strengths outweigh the fact that the company has had sub par growth in net income.”

You can view the full analysis from the report here: MTB Ratings Report18. Suncor Energy, Inc. (SU)

Shares Held by Warren Buffett's Berkshire Hathaway: 16,458,000 shares Value of Holdings: $702 million Portfolio Weighting as of 06/30/2014: 0.65%

Suncor Energy Inc., together with its subsidiaries, operates as an integrated energy company.

The company primarily focuses on developing petroleum resource basins in Canada's Athabasca oil sands; explores, acquires, develops, produces, and markets crude oil and natural gas in Canada and internationally; transports and refines crude oil; markets petroleum and petrochemical products primarily in Canada; and markets third-party petroleum products. It operates in Oil Sands; Exploration and Production; Refining and Marketing; and Corporate, Energy Trading, and Eliminations segments.

Free Report: Jim Cramer's Best Stocks for 2014

TheStreet Ratings team rates SUNCOR ENERGY INC as a Buy with a ratings score of B. TheStreet Ratings Team has this to say about their recommendation:

“We rate SUNCOR ENERGY INC (SU) a BUY. This is driven by a few notable strengths, which we believe should have a greater impact than any weaknesses, and should give investors a better performance opportunity than most stocks we cover. The company's strengths can be seen in multiple areas, such as its revenue growth, largely solid financial position with reasonable debt levels by most measures, reasonable valuation levels, solid stock price performance and notable return on equity. We feel these strengths outweigh the fact that the company has had sub par growth in net income.”

You can view the full analysis from the report here: SU Ratings Report17. Chicago Bridge & Iron Company (CBI)

Shares Held by Warren Buffett's Berkshire Hathaway: 10,701,000 shares Value of Holdings: $730 million Portfolio Weighting as of 06/30/2014: 0.68%

Chicago Bridge & Iron Company N.V. provides conceptual design, technology, engineering, procurement, fabrication, modularization, construction, commissioning, maintenance, program management, and environmental services to customers in the energy infrastructure worldwide.

Free Report: Jim Cramer's Best Stocks for 2014

TheStreet Ratings team rates CHICAGO BRIDGE & IRON CO as a Buy with a ratings score of B-. TheStreet Ratings Team has this to say about their recommendation:

“We rate CHICAGO BRIDGE & IRON CO (CBI) a BUY. This is driven by a few notable strengths, which we believe should have a greater impact than any weaknesses, and should give investors a better performance opportunity than most stocks we cover. The company's strengths can be seen in multiple areas, such as its robust revenue growth, notable return on equity, impressive record of earnings per share growth and compelling growth in net income. We feel these strengths outweigh the fact that the company shows weak operating cash flow.”

You can view the full analysis from the report here: CBI Ratings Report16. Verizon Communications, Inc. (VZ)

Shares Held by Warren Buffett's Berkshire Hathaway: 15,001,000 shares Value of Holdings: $734 million Portfolio Weighting as of 06/30/2014: 0.68%

Verizon Communications Inc. provides communications, information, and entertainment products and services to consumers, businesses, and governmental agencies worldwide.

Free Report: Jim Cramer's Best Stocks for 2014

TheStreet Ratings team rates VERIZON COMMUNICATIONS INC as a Buy with a ratings score of B. TheStreet Ratings Team has this to say about their recommendation:

“We rate VERIZON COMMUNICATIONS INC (VZ) a BUY. This is driven by multiple strengths, which we believe should have a greater impact than any weaknesses, and should give investors a better performance opportunity than most stocks we cover. The company's strengths can be seen in multiple areas, such as its revenue growth, notable return on equity, compelling growth in net income, expanding profit margins and impressive record of earnings per share growth. We feel these strengths outweigh the fact that the company has had generally high debt management risk by most measures that we evaluated.”

You can view the full analysis from the report here: VZ Ratings Report15. The Bank of New York Mellon Corp. (BK)

Shares Held by Warren Buffett's Berkshire Hathaway: 24,653,000 shares Value of Holdings: $924 million Portfolio Weighting as of 06/30/2014: 0.86%

The Bank of New York Mellon Corporation provides various financial products and services in the United States and internationally.

Its Investment Management segment provides institutional, intermediary, retirement and retail investment management, distribution, and related services.

Free Report: Jim Cramer's Best Stocks for 2014

TheStreet Ratings team rates BANK OF NEW YORK MELLON CORP as a Buy with a ratings score of A. TheStreet Ratings Team has this to say about their recommendation:

“We rate BANK OF NEW YORK MELLON CORP (BK) a BUY. This is based on the convergence of positive investment measures, which should help this stock outperform the majority of stocks that we rate. The company's strengths can be seen in multiple areas, such as its reasonable valuation levels, solid stock price performance, expanding profit margins and notable return on equity. We feel these strengths outweigh the fact that the company has had sub par growth in net income.”

You can view the full analysis from the report here: BK Ratings Report14. USG Corp. (USG)

Shares Held by Warren Buffett's Berkshire Hathaway: 39,002,000 shares Value of Holdings: $1.175 billion Portfolio Weighting as of 06/30/2014: 1.1%

USG Corporation, through its subsidiaries, operates as a manufacturer and distributor of building materials worldwide.

It operates in three segments: North American Gypsum, Worldwide Ceilings, and Building Products Distribution.

Free Report: Jim Cramer's Best Stocks for 2014

TheStreet Ratings team rates USG CORP as a Hold with a ratings score of C. TheStreet Ratings Team has this to say about their recommendation:

“We rate USG CORP (USG) a HOLD. The primary factors that have impacted our rating are mixed ? some indicating strength, some showing weaknesses, with little evidence to justify the expectation of either a positive or negative performance for this stock relative to most other stocks. The company's strengths can be seen in multiple areas, such as its revenue growth, notable return on equity and reasonable valuation levels. However, as a counter to these strengths, we also find weaknesses including generally higher debt management risk and poor profit margins.

You can view the full analysis from the report here: USG Ratings Report13. General Motors Co. (GM)

Shares Held by Warren Buffett's Berkshire Hathaway: 32,960,000 shares Value of Holdings: $1.196 billion Portfolio Weighting as of 06/30/2014: 1.1%

General Motors Company (GM) designs, manufactures, and markets cars, crossovers, trucks, and automobile parts worldwide.

The company markets its vehicles primarily under the Buick, Cadillac, Chevrolet, GMC, Opel, Holden, and Vauxhall brand names, as well as under the Alpheon, Jiefang, Baojun, and Wuling brand names.

Free Report: Jim Cramer's Best Stocks for 2014

TheStreet Ratings team rates GENERAL MOTORS CO as a Buy with a ratings score of B. TheStreet Ratings Team has this to say about their recommendation:

“We rate GENERAL MOTORS CO (GM) a BUY. This is driven by some important positives, which we believe should have a greater impact than any weaknesses, and should give investors a better performance opportunity than most stocks we cover. The company's strengths can be seen in multiple areas, such as its revenue growth and largely solid financial position with reasonable debt levels by most measures. We feel these strengths outweigh the fact that the company has had lackluster performance in the stock itself.”

You can view the full analysis from the report here: GM Ratings Report12. DirecTV (DTV)

Shares Held by Warren Buffett's Berkshire Hathaway: 23,468,000 shares Value of Holdings: $1.995 billion Portfolio Weighting as of 06/30/2014: 1.9%

DIRECTV provides digital television entertainment services in the United States and Latin America.

The company acquires, promotes, sells, and distributes digital entertainment programming primarily through satellite to residential and commercial subscribers.

Free Report: Jim Cramer's Best Stocks for 2014

TheStreet Ratings team rates DIRECTV as a Hold with a ratings score of C+. TheStreet Ratings Team has this to say about their recommendation:

“We rate DIRECTV (DTV) a HOLD. The primary factors that have impacted our rating are mixed ? some indicating strength, some showing weaknesses, with little evidence to justify the expectation of either a positive or negative performance for this stock relative to most other stocks. The company's strengths can be seen in multiple areas, such as its solid stock price performance, growth in earnings per share and increase in net income. However, as a counter to these strengths, we find that we feel that the company's cash flow from its operations has been weak overall.”

You can view the full analysis from the report here: DTV Ratings Report11. The Goldman Sachs Group, Inc. (GS)

Shares Held by Warren Buffett's Berkshire Hathaway: 12,632,000 shares Value of Holdings: $2.115 billion Portfolio Weighting as of 06/30/2014: 2.0%

The Goldman Sachs Group, Inc. provides investment banking, securities, and investment management services to corporations, financial institutions, governments, and high-net-worth individuals worldwide.

Free Report: Jim Cramer's Best Stocks for 2014

TheStreet Ratings team rates GOLDMAN SACHS GROUP INC as a Buy with a ratings score of B+. TheStreet Ratings Team has this to say about their recommendation:

“We rate GOLDMAN SACHS GROUP INC (GS) a BUY. This is driven by a number of strengths, which we believe should have a greater impact than any weaknesses, and should give investors a better performance opportunity than most stocks we cover. The company's strengths can be seen in multiple areas, such as its revenue growth, attractive valuation levels, growth in earnings per share, increase in net income and increase in stock price during the past year. We feel these strengths outweigh the fact that the company has had somewhat disappointing return on equity.”

You can view the full analysis from the report here: GS Ratings Report10. Moody's Corporation (MCO)

Shares Held by Warren Buffett's Berkshire Hathaway: 24,670,000 shares Value of Holdings: $2.163 billion Portfolio Weighting as of 06/30/2014: 2.0%

Moody's Corporation provides credit ratings; and credit, capital markets, and economic related research, data, and analytical tools worldwide.

Free Report: Jim Cramer's Best Stocks for 2014

TheStreet Ratings team rates MOODY'S CORP as a Buy with a ratings score of A-. TheStreet Ratings Team has this to say about their recommendation:

“We rate MOODY'S CORP (MCO) a BUY. This is based on the convergence of positive investment measures, which should help this stock outperform the majority of stocks that we rate. The company's strengths can be seen in multiple areas, such as its revenue growth, notable return on equity, reasonable valuation levels, expanding profit margins and good cash flow from operations. We feel these strengths outweigh the fact that the company has had generally high debt management risk by most measures that we evaluated.”

You can view the full analysis from the report here: MCO Ratings Report9. DaVita HealthCare Partners, Inc. (DVA)

Shares Held by Warren Buffett's Berkshire Hathaway: 37,621,000 shares Value of Holdings: $2.721 billion Portfolio Weighting as of 06/30/2014: 2.5%

DaVita HealthCare Partners Inc. provides kidney dialysis services for patients suffering from chronic kidney failure or end stage renal disease.

It operates kidney dialysis centers and provides related lab services primarily in outpatient dialysis centers and in contracted hospitals.

Free Report: Jim Cramer's Best Stocks for 2014

TheStreet Ratings team rates DAVITA HEALTHCARE PARTNERS as a Buy with a ratings score of B+. TheStreet Ratings Team has this to say about their recommendation:

“We rate DAVITA HEALTHCARE PARTNERS (DVA) a BUY. This is driven by several positive factors, which we believe should have a greater impact than any weaknesses, and should give investors a better performance opportunity than most stocks we cover. The company's strengths can be seen in multiple areas, such as its solid stock price performance, revenue growth and notable return on equity. We feel these strengths outweigh the fact that the company has had sub par growth in net income.”

You can view the full analysis from the report here: DVA Ratings Report8. U.S. Bancorp (USB)

Shares Held by Warren Buffett's Berkshire Hathaway: 80,094,000 shares Value of Holdings: $3.470 billion Portfolio Weighting as of 06/30/2014: 3.2%

U.S. Bancorp, a financial services holding company, provides a range of financial services in the United States.

Its services include lending and depository, cash management, capital market, and trust and investment management services, as well as merchant and ATM processing, mortgage banking, and brokerage services.

Free Report: Jim Cramer's Best Stocks for 2014

TheStreet Ratings team rates U S BANCORP as a Buy with a ratings score of A-. TheStreet Ratings Team has this to say about their recommendation:

“We rate U S BANCORP (USB) a BUY. This is based on the convergence of positive investment measures, which should help this stock outperform the majority of stocks that we rate. The company's strengths can be seen in multiple areas, such as its revenue growth, expanding profit margins, increase in stock price during the past year, increase in net income and growth in earnings per share. We feel these strengths outweigh the fact that the company has had somewhat disappointing return on equity.”

You can view the full analysis from the report here: USB Ratings Report7. Exxon Mobil Corporation (XON)

Shares Held by Warren Buffett's Berkshire Hathaway: 41,130,000 shares Value of Holdings: $4.141 billion Portfolio Weighting as of 06/30/2014: 3.8%

Exxon Mobil Corporation explores and produces for crude oil and natural gas.

As of December 31, 2013, the company had approximately 37,661 gross and 31,823 net operated wells.

Free Report: Jim Cramer's Best Stocks for 2014

TheStreet Ratings team rates EXXON MOBIL CORP as a Buy with a ratings score of A-. TheStreet Ratings Team has this to say about their recommendation:

“We rate EXXON MOBIL CORP (XOM) a BUY. This is based on the convergence of positive investment measures, which should help this stock outperform the majority of stocks that we rate. The company's strengths can be seen in multiple areas, such as its revenue growth, attractive valuation levels, good cash flow from operations, increase in net income and largely solid financial position with reasonable debt levels by most measures. We feel these strengths outweigh the fact that the company shows low profit margins.”

You can view the full analysis from the report here: XOM Ratings Report6. Procter & Gamble Co. (PG)

Shares Held by Warren Buffett's Berkshire Hathaway: 52,793,000 shares Value of Holdings: $4.149 billion Portfolio Weighting as of 06/30/2014: 3.9%

The Procter & Gamble Company, together with its subsidiaries, manufactures and sells branded consumer packaged goods.

The company operates through five segments: Beauty, Grooming, Health Care, Fabric Care and Home Care, and Baby Care and Family Care.

Free Report: Jim Cramer's Best Stocks for 2014

TheStreet Ratings team rates PROCTER & GAMBLE CO as a Buy with a ratings score of A-. TheStreet Ratings Team has this to say about their recommendation:

“We rate PROCTER & GAMBLE CO (PG) a BUY. This is based on the convergence of positive investment measures, which should help this stock outperform the majority of stocks that we rate. The company's strengths can be seen in multiple areas, such as its growth in earnings per share, increase in net income, good cash flow from operations, largely solid financial position with reasonable debt levels by most measures and notable return on equity. We feel these strengths outweigh the fact that the company has had lackluster performance in the stock itself.”

You can view the full analysis from the report here: PG Ratings Report5. Wal-Mart Stores, Inc. (WMT)

Shares Held by Warren Buffett's Berkshire Hathaway: 58,797,000 shares Value of Holdings: $4.414 billion Portfolio Weighting as of 06/30/2014: 4.1%

Wal-Mart Stores Inc. operates retail stores in various formats worldwide.

The company operates through three segments: Walmart U.S., Walmart International, and Sam's Club.

Free Report: Jim Cramer's Best Stocks for 2014

TheStreet Ratings team rates WAL-MART STORES INC as a Buy with a ratings score of B+. TheStreet Ratings Team has this to say about their recommendation:

“We rate WAL-MART STORES INC (WMT) a BUY. This is driven by multiple strengths, which we believe should have a greater impact than any weaknesses, and should give investors a better performance opportunity than most stocks we cover. The company's strengths can be seen in multiple areas, such as its revenue growth, good cash flow from operations, reasonable valuation levels and notable return on equity. We feel these strengths outweigh the fact that the company has had lackluster performance in the stock itself.”

You can view the full analysis from the report here: WMT Ratings Report4. International Business Machines Corp. (IBM)

Shares Held by Warren Buffett's Berkshire Hathaway: 70,174,000 shares Value of Holdings: $12.720 billion Portfolio Weighting as of 06/30/2014: 11.8%

International Business Machines Corporation provides information technology (IT) products and services worldwide.

The companys Global Technology Services segment provides IT infrastructure and business process services, including outsourcing, process, integrated technology, cloud, and technology support.

Free Report: Jim Cramer's Best Stocks for 2014

TheStreet Ratings team rates WAL-MART STORES INC as a Buy with a ratings score of B+. TheStreet Ratings Team has this to say about their recommendation:

“We rate WAL-MART STORES INC (WMT) a BUY. This is driven by multiple strengths, which we believe should have a greater impact than any weaknesses, and should give investors a better performance opportunity than most stocks we cover. The company's strengths can be seen in multiple areas, such as its revenue growth, good cash flow from operations, reasonable valuation levels and notable return on equity. We feel these strengths outweigh the fact that the company has had lackluster performance in the stock itself.”

You can view the full analysis from the report here: WMT Ratings Report3. American Express Company (AXP)

Shares Held by Warren Buffett's Berkshire Hathaway: 151,611,000 shares Value of Holdings: $14,383 billion Portfolio Weighting as of 06/30/2014: 13.4%

American Express Company, together with its subsidiaries, provides charge and credit payment card products and travel-related services to consumers and businesses worldwide.

The company operates through four segments: U.S. Card Services, International Card Services, Global Commercial Services, and Global Network & Merchant Services.

Free Report: Jim Cramer's Best Stocks for 2014

TheStreet Ratings team rates AMERICAN EXPRESS CO as a Buy with a ratings score of A-. TheStreet Ratings Team has this to say about their recommendation:

“We rate AMERICAN EXPRESS CO (AXP) a BUY. This is based on the convergence of positive investment measures, which should help this stock outperform the majority of stocks that we rate. The company's strengths can be seen in multiple areas, such as its revenue growth, notable return on equity, growth in earnings per share, increase in net income and solid stock price performance. We feel these strengths outweigh the fact that the company has had generally high debt management risk by most measures that we evaluated.”

You can view the full analysis from the report here: AXP Ratings Report2. The Coca-Cola Company (KO)

Shares Held by Warren Buffett's Berkshire Hathaway: 400,000,000 shares Value of Holdings: $16,944 billion Portfolio Weighting as of 06/30/2014: 15.8%

The Coca-Cola Company, a beverage company, manufactures and distributes coke, diet coke, and other soft drinks worldwide.

The company primarily offers nonalcoholic beverages, including sparkling beverages and still beverages.

Free Report: Jim Cramer's Best Stocks for 2014

TheStreet Ratings team rates COCA-COLA CO as a Buy with a ratings score of A. TheStreet Ratings Team has this to say about their recommendation:

“We rate COCA-COLA CO (KO) a BUY. This is based on the convergence of positive investment measures, which should help this stock outperform the majority of stocks that we rate. The company's strengths can be seen in multiple areas, such as its expanding profit margins, reasonable valuation levels and notable return on equity. We feel these strengths outweigh the fact that the company has had lackluster performance in the stock itself.”

You can view the full analysis from the report here: KO Ratings Report1. Wells Fargo & Company (WFC)

Shares Held by Warren Buffett's Berkshire Hathaway: 463,458,000 shares Value of Holdings: $24.359 billion Portfolio Weighting as of 06/30/2014: 22.6%

Wells Fargo & Company provides retail, commercial, and corporate banking services to individuals, businesses, and institutions.

The company's Community Banking segment offers checking and market rate accounts, savings and time deposits, individual retirement accounts, and remittances; and lines of credit, auto floor plan lines, equity lines and loans, equipment and transportation loans, education and residential mortgage loans, and credit and debit cards.

Free Report: Jim Cramer's Best Stocks for 2014

TheStreet Ratings team rates WELLS FARGO & CO as a Buy with a ratings score of A. TheStreet Ratings Team has this to say about their recommendation:

“We rate WELLS FARGO & CO (WFC) a BUY. This is based on the convergence of positive investment measures, which should help this stock outperform the majority of stocks that we rate. The company's strengths can be seen in multiple areas, such as its solid stock price performance, increase in net income, expanding profit margins and growth in earnings per share. We feel these strengths outweigh the fact that the company shows weak operating cash flow.”

You can view the full analysis from the report here: WFC Ratings Report